Are you dreaming of owning your own home? Or finally moving out of that “starter home” you bought 10 years ago – before the market went crazy and interest rates started to creep up? The State of Ohio has taken feedback from residents and come up with the Ohio Homebuyer Plus Program. They’re partnering with banks all over the state to offer an account with above-market interest rates and state income tax deductions to make buying a new home more achievable.

Richwood Bank jumped at the opportunity to be part of this program. We truly believe that building a strong financial future includes owning your own home. With this account, you’ll always enjoy our best interest rate, giving you a competitive edge in growing your savings.

What about the time limit?

The Ohio Homebuyer Plus Program provides you with a five-year window to save up for the down payment and closing costs of your new home. Now some of you may be hesitant to dive in because you’re not sure if you’ll be ready in that time. The State understands that a lot can happen in five years, and we’ve seen nothing from them that indicates people who don’t use the funds in the allotted time will face a penalty. The only instance where you may find yourself owing money would be if you took advantage of the tax deductions. Your tax advisor can help you weigh those possibilities and guide you to the best decision.

Looking to build?

It’s important to note that the Ohio Homebuyer Plus Program is specifically designed for purchasing existing homes. If your dream is to build a new home, this program may not be the right fit for you. Additionally, it’s not intended for refinancing or purchasing secondary homes or income properties. If you’re not looking to buy a home in Ohio that you plan to live in yourself, this program isn’t for you.

How can I learn more about the details?

The State has provided the Participation Statement on their website: https://tos.ohio.gov/files/Pdfs/HomebuyerPlusParticipation.pdf. This document provides important details on eligibility of both individuals and homes. The most important details are that savers must be at least 18 years of age, currently a resident of Ohio, and looking to purchase a primary home in Ohio. There is a limit of one account per social security number, which the State will verify before approving the new account. It is an individual owner account, so couples have the option to open one in each of their names. At the end of your savings period, you could both use funds for the same purchase.

Richwood is here to support your dreams

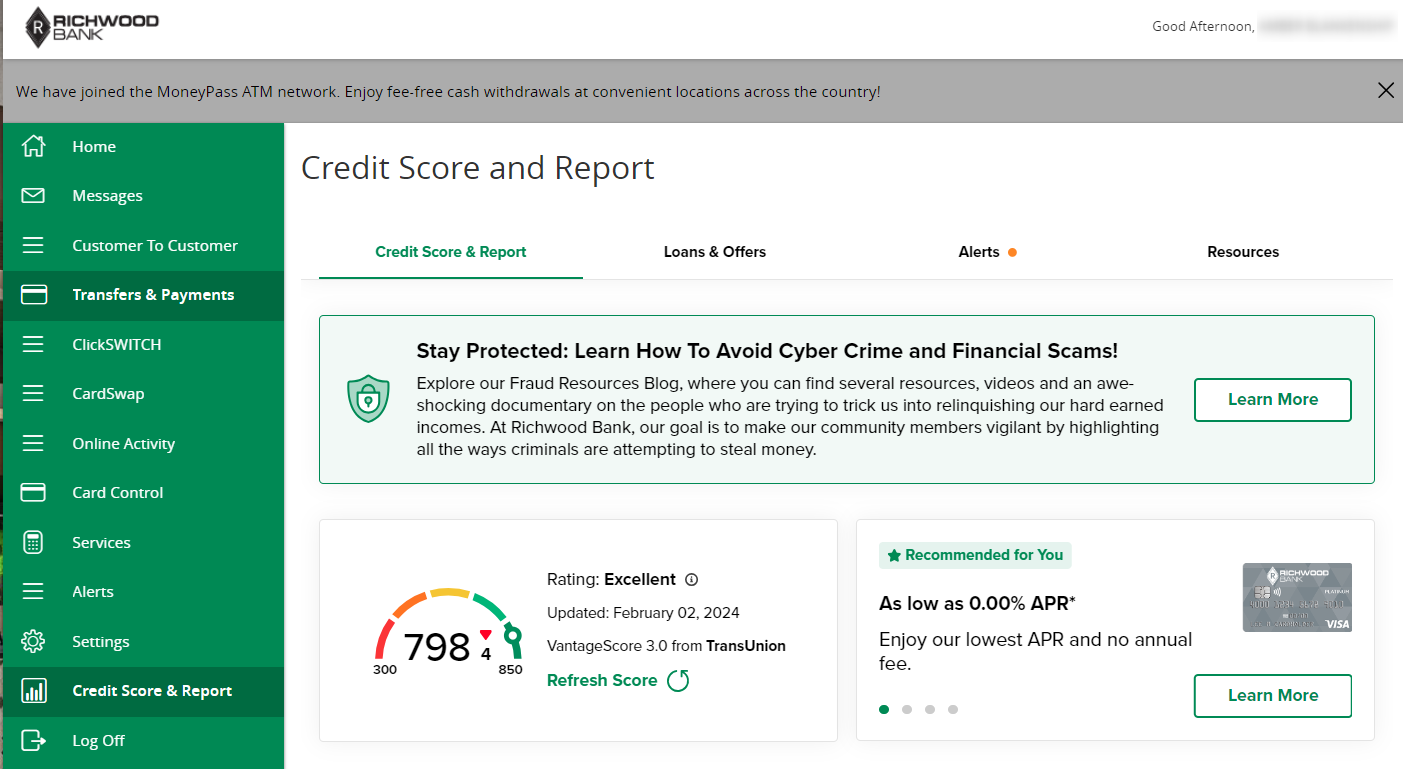

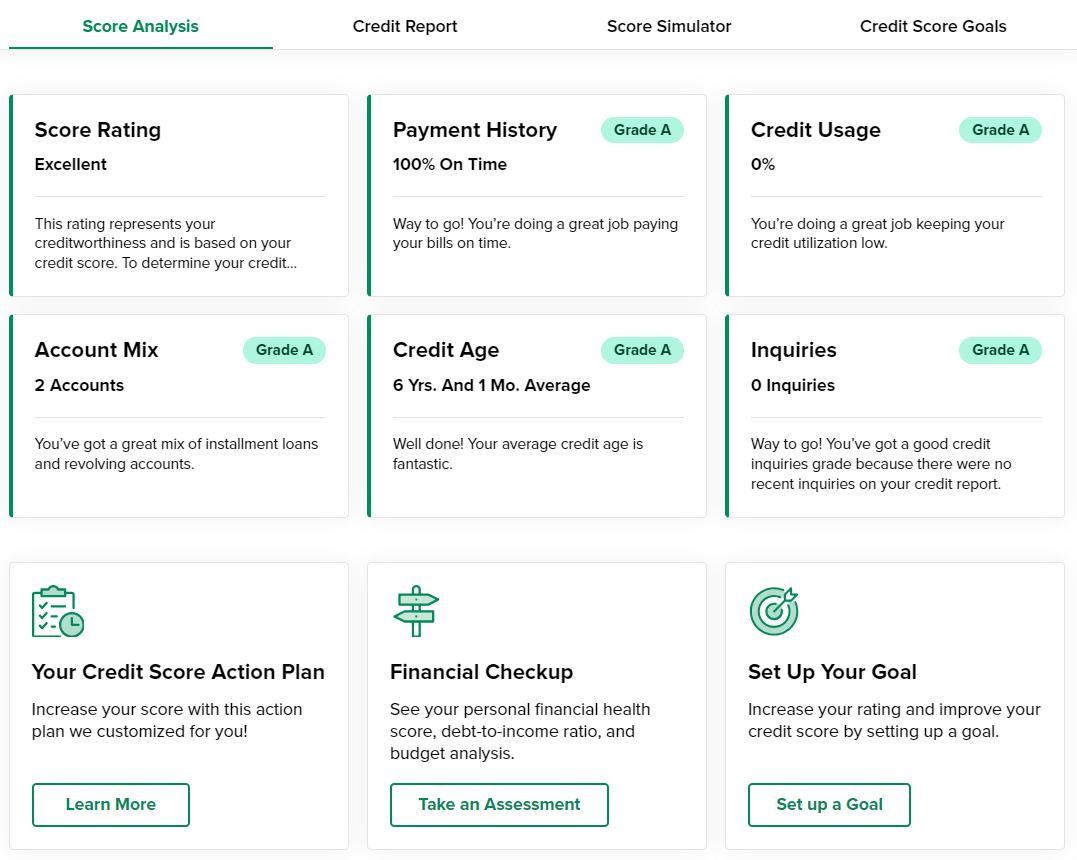

In addition to offering the Ohio Homebuyer Plus Program, Richwood Bank provides other resources to help you prepare for your home purchase journey. Our credit monitoring tool, available in your online banking, allows you to keep track of your credit score, receive updates and alerts for any changes, and create a plan to improve your score if needed. If you haven’t enabled this feature yet, we encourage you to do so and take advantage of all the helpful tools to get your credit in tip-top shape. It will ensure you get the best rate and terms on your mortgage when it comes time to purchase your home.

More tools to get you ready

For valuable insights into the full costs of a mortgage and helpful information about the homebuying process, visit https://richwoodbank.banzai.org/wellness/resources/the-cost-of-a-mortgage. Our mortgage lenders are also here to answer any questions you may have about the homebuying process.

We’re here to help

Interested in taking advantage of this program? Head over to https://richwoodbank.com/ohio-homebuyer-plus-savings/ to see the details of the account. As always, our team is here to answer any questions you may have so you can make financial decisions with confidence.