At Richwood Bank, we're committed to fostering a community where financial knowledge is accessible to all. Because when you're empowered with financial literacy, you're equipped to make sound decisions, pursue your dreams, and achieve your goals.

Whether you're a curious youngster learning the basics, a high school student preparing for life's adventures, or an adult seeking to make informed decisions, financial literacy is your compass to navigate the world of money confidently.

Banzai for Education

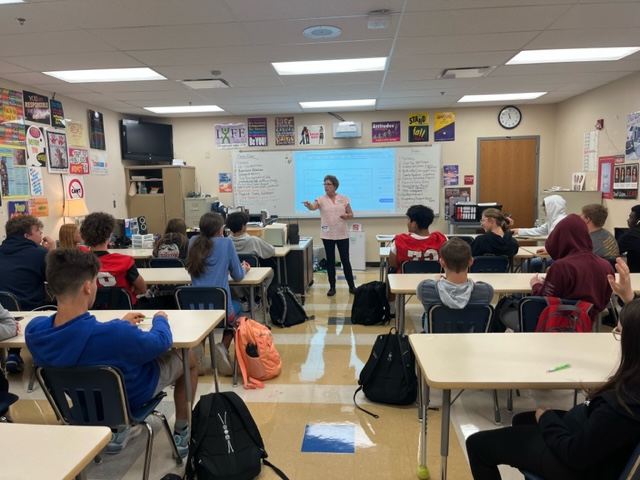

Banzai is a premium online program that helps educators meet state mandated financial literacy requirements. Richwood Bank pays for the program and offers it for free to over 30 local schools. Teachers are provided with printed materials, lesson plans, and an interactive online platform that allows students to engage with real-world scenarios.

Richwood also makes employees available to present to classrooms. Even if you’re not part of the Banzai program, we’re happy to visit schools to share the importance of good financial decisions.

Help your kids be financially ready for the future

Banzai Junior provides real-life scenarios that show users how to make wise decisions when faced with financial dilemmas. Designed for kids aged 8 to 12, Banzai Junior uses the storyline of a summer lemonade stand and the goal of a new bike—or hoverboard for the financially daring—to teach concepts like interest and fees, envelope budgeting, and discretionary income.

Continuous learning is key to financial success

While some may believe adults have all the answers, there’s always more to learn when it comes to making the most of your finances. That’s why our blog is designed to empower you with practical insights and actionable tips that resonate with your everyday financial decisions.

Provide financial literacy for your community

We understand the pivotal role non-profit organizations play in supporting communities. By partnering with Richwood Bank, your organization gains access to comprehensive financial education programs tailored to the unique needs of your team or community groups. Our programs cover a wide spectrum of financial topics, including budgeting, saving strategies, credit management, investing fundamentals, retirement planning, and more.