On Monday, May 11th the Chamber of Greater Springfield hosted a webinar for business owners to ask direct questions to Alex Kohls, a representative from the SBA. The notes below and video of the event cover the 65 questions and answers presented during the forum.

| Question Report | Chamber of Greater Springfield Webinar Series | |

| Report Generated: | 5/12/2020 16:10 | |

| Topic | Webinar ID | # Question |

| PPP Loan Forgiveness – Presented by SBA | 842 5029 0951 | 65 |

| Question Details | ||

| # |

Business Question |

SBA Answer(s) |

| 1 | Are the fees I pay to subcontractors, like my virtual assistant, allowable? | No. Direct payroll costs only. |

| 2 | IS THE PORTION OF GROSS PAY THAT IS FEDERAL WITHHOLDING NOT COUNTED | Correct. |

| 3 | If federal income tax and FICA withheld are not eligible, does that mean that we can only count employee compensation NET of those amounts withheld? | Correct |

| 4 | For level of payroll – Pre covid levels – what is the date range that we need to use to figure up the number of employees allowed? For instance is there a month range that you need to figure the number of employees at? I.e. 01/01/19-12/31/19 or a quarter range? | Payroll amounts at submission. Average # employees |

| 5 | If an employee is scheduled to work full time (40 hours per week), but chooses to work less or not at all for a few weeks, and their time not worked is not compensated as vacation or sick pay, is that employee still considered full time. | They must be getting paid to be eligible for forgiveness. |

| 6 | Will there be a template for us to use? | Maybe, but probably not. Best Practice is to set up a separate account for PPP. |

| 7 | I am a sole proprietor who uses subcontractors including a virtual assistant. It’s a home office so it wouldn’t make sense to try to figure out the business’ share of the mortgage. Should I use all of my loan for pure payroll expenses? It would mean I pay myself two months’ payroll, one larger than the other. No other costs. | Purely payroll is ideal. |

| 8 | What type of documentation will be required when we apply for forgiveness? | That is still being figured out . . . |

| 9 | IF A PAY PERIOD IS PART BEFORE AND PART AFTER FUNDING BUT ALL PAID AFTER FUNDING. WHAT AMOUNT DO YOU USE. | The clock starts once you get the disbursement. It cannot be retroactive applied. |

| 10 | If you received funds on a Wednesday, will the eight weeks then end on a Wednesday? | Yes |

| 11 | What happens on forgiveness when your 8-week period starts and ends in the middle of a pay week ? | It must start when the loan is received. |

| 12 | I have numerous part time employees. I calculated the hours worked previous to covid and determined that I have 7.5 Full time equivalent employees. As long as I still have hours that add up to 7.5 FTE employees is that acceptable? I have had a couple staff quit, but my existing staff want more hours so that should make up for the two staff that have left. Just want to make sure | That will most likely work. |

| 13 | are stipends for front line workers, deemed necessary to retain staff, allowable? If so, how much/limit? | No |

| 14 | Can you make payroll payments to employees through bank transfer and what type of book keeping will be expected? Also, how would you pay and/or document interest only payments with PPP funds? Both questions as it relates to loan forgiveness? | Just as long as there is good documentation it should be fine. A separate account is the best. |

| 15 | Are you able to use the PPP loan for preapproved uses even if they were not defined within the company’s PPP loan application? | No. Must be for what the application stated. Again, document and you may be able to justify. |

| 16 | Are they dates available you are looking at for number of staff at pre – covid level? | 15-Feb-20 |

| 17 | Would it cover short term & long term disability insurance, eye or dental? | yes on eye and dental. Short-term and long-term will follow-up. |

| 18 | What if employees effectivley quit, and the company is having issues finding suitable re-hires? | Will follow-up |

| 19 | Can you use life insurance for a reimbursement under PPP loan? Our company pays life insurance for all employee’s. Can we use those amounts? | Probably, further clarification to follow. |

| 20 | on expenses, is it the time incurred or check written date? | Time incurred |

| 21 | Has it been determined how full-time equivalents are to be calculated? | 40 hrs = 1 FTE |

| 22 | When will the forgiveness guidelines be identified? | Any day . . . Bookmark the treasury website daily. |

| 23 | What type of documentation is going to be required with regards to amount of payroll and number of employees so that the maximum amount of the PPP loan can be forgiven? | No guidance available yet. |

| 24 | How about payroll costs for temporary employees? | It’s based whoever you are supplying a W-2 issued by the employer. |

| 25 | We applied for the $10K advance immediately when it was announced and then later applied for PPP. We received our PPP at the end of April, about 100K. Just last week we got the $10K as well. Are we able to spend 110K on the proper items (payroll, benefits, rent, utilites, etc) for the 8 week period or are we still limited to the 100K? | Limited to the $100K |

| 26 | we received $$ & I am doing recordkeeping of my payroll & utility costs. At the end of the 8 weeks, who do I turn this into at end of 8 weeks to show how I used money | Apply through the bank for the forgiveness |

| 27 | Eligibility, what will they need to provide to prove they qualified/were eligible for PPP? | 1. Small Business by Sba.gov standards, 2. Operating prior to Covid-19 |

| 28 | I have 16 employees on payroll, but partner and I are not. Is the guaranteed pay that we usually receive from the business an allowable expense? | Yes |

| 29 | For medical insurance…employees pay $1,000 per month, company pays $5,000…can we use $6,000 for the PPP loan reimbursement or do we use the $5,000 only, since that is employer paid. | $5,000 only. But will seek further clarification. |

| 30 | If you received the loan money in April, can it be used for March Payroll when everything got shut down? | No. Only from when you receive the disbursement. |

| 31 | Due to pay dates and the 8 weeks forgiveness timeframe, can payroll and or health insurance be pre-paid and qualify for the forgiveness calculation? | no |

| 32 | ARE GUARANTEED PAYMENTS TO PARTNERS CONSIDERED PAYROLL | Yes |

| 33 | employee compensation cannot exceed $100k (gross wages – right?). Is that amount for the calendar year ending dec 31, 2020? | Based on previous year’s gross wages. |

| 34 | Schedule C/ K-1….what will they need to provide to show where funds went if it goes directly too “payroll”. Will the transfer from PPP account to operating suffice? | That’s a question for accounting pehaps. Just documnet as well. |

| 35 | We pay for employee benefits (medical insurance, etc.) a month in advance. Should I use the insurance billing that covers the 8-week period, or should I use the invoices that are PAID in the 8-week period? | Paid invoices. Seeking further guidance. |

| 36 | You stated that you start counting the 8 weeks as of when the money went into your account. So for payroll, the actual hours worked are incurred prior to the date of the paycheck. So do you use the date of hours worked or date of paycheck? | Date of the paycheck |

| 37 | What is the maximum time period the SBA could audit your PPP Loan ? | Do not know |

| 38 | If the business entity is a partnership in which the partners share income after payment of employee wages, and other expenses, can payment to partners be forgivable? | Yes |

| 39 | can we write off expenses paid with the PPP loan on our 2020 tax return | no |

| 40 | I am a sole proprietor so the only employee. Must my self-payroll payments be divided weekly or can I disburse funds in lump payments that are not equal? | divided weekly, but check on the Treasury website. |

| 41 | So, if clock starts after disbursement and you were in the middle of the two week payroll period when the money arrived, are you still able to pay the last week of payroll the week after the “official” end of your 8 weeks that was within the 8 weeks but not paid out until the 9th week?. | No, It must be within an 8week period |

| 42 | Can you give a bonus with PPP funds? Hazard Pay? Thoughts? | No |

| 43 | Due to the confusion with how the average monthly payroll is being calculated, if the amount was calculated incorrectly, what will happen? | Work with your lender to correct. |

| 44 | Looking ahead, it’s going to be difficult to have 75% in just payroll expenses. When applying for the loan, all numbers were calculated together, payroll wasn’t submitted at 75% of total. Do you think they may make an adjustment since we multiplied by 2.5 and we really only have 2 months to spend down funds. | There will likely be adjustments but probably not to this portion. The extra 0.5% was for “extra” bills. |

| 45 | If we have a full time employee that is laid off at the start of this and decides not to work because of the virus. what do we do about their hours | Depends on the business. If they are paid, then they are eligible. |

| 46 | What is the time frame for which you can incur expenses that you intend to request be forgiven (i.e. are forgivable expenses restricted to the period of the PPP Loan?) | yes |

| 47 | So if staff received pay raises due to hazard pay, the portion to be forgiven would be based on rates from prior year? | yes |

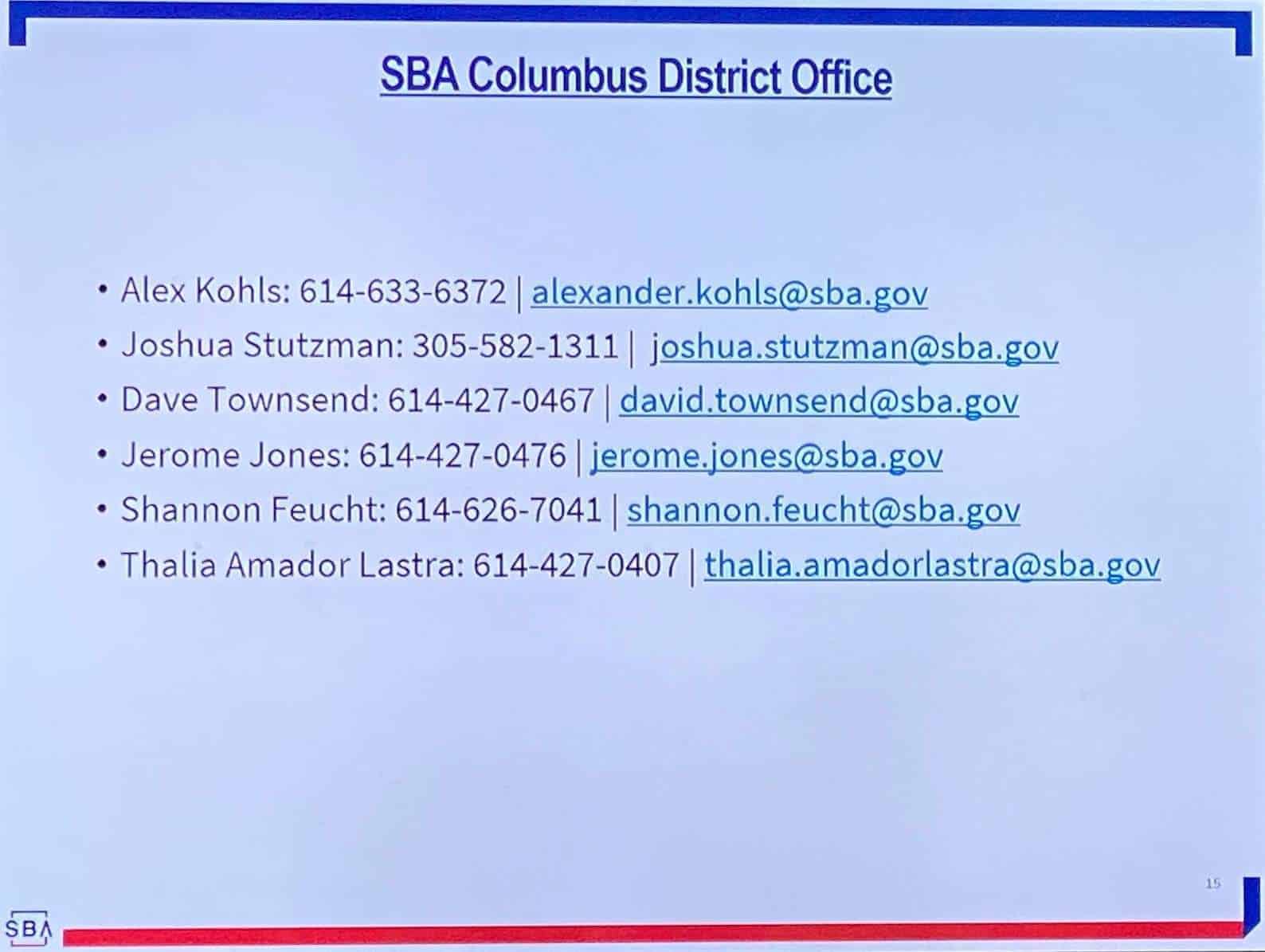

| 48 | My loan was based on 2 people but I had 3 before covid. 2 employees work 30 to 35 hours. Is forgiveness based on the number of people that the loan was based on? | please email Alex. alexander.kohls@sba.gov |

| 49 | If we received the funding today, can we wait to start using it until the next payroll cycle? I’m getting mixed signals on this call. | The clock starts the moment you receive the funds. |

| 50 | We have employees that are paid Pro Sal. The production is paid in the following month-April production is paid in May- can the production be paid from the PPP funds if we did not receive the funds until the end of April and the production amount is for the entire month of April? | Eligibility form receipt of funds only |

| 51 | If, based on poor advice, I applied and received a PPP loan based on gross monthly payroll, should I only use the portion that equals net pay and state taxes and be prepared to return the rest? | You should do net pay. |

| 52 | In other words should I be prepared to return the amount of my gross monthly payroll that represents federal withholding? | yes |

| 53 | If we received the money in our account on 4/29/2020 does the 8 weeks start on the 29th or the 30th? | 29th |

| 54 | Assuming the $100,000 max, will you be penalized for paying less since the cap is $15,385 per employee? (This would put the payroll at roughly 73% for that individual?) | Yes. |

| 55 | So we can write checks after the 8 weeks for expenses incurred during the 8 weeks? | Seeking clarification. |

| 56 | if there are new employees being hired in the 8 week period and not included in the prior year payroll, will forgiveness apply to payroll for these new employees. | They will not |

| 57 | Schedule C with a Payroll: Over and above the $15,385 cap, can those funds claimed with the schedule C figures also be used towards approved Business expenses? | Nothing is allowable over the cap. |

| 58 | How does the FTE re-hire exemption work for Part Time employees whose hours flex from week to week? | based on FTE amount averages. |

| 59 | How does the 25% pay reduction work when someone quit and is replaced by someone else? | It is in the Treasury guidance. Document will be emailed. |

| 60 | Once your 8 week period is ended, how much time does the borrower have to apply for forgiveness? | Still awaiting word from SBA |

| 61 | Have a small company. No employees, only owner. Owners Only receive weekly draws. Received less than $10,000 for the PPP loan. Our accountant told company that SBA would forgive all loans under $15,000. Can you confirm that? | Alex has not heard that |

| 62 | Rent question….received PPP money in late April, and April rent had not yet been paid. Since it was still in April, can April rent also be paid in addition to May & June. as it would be within the 8 week period? Appologies if this has been addressed and I missed it! | Further guidance will be emailed. |

| 63 | We get paid monttly may is not a problem. June pay period ends 4 days after the 8 weeks is. | Seeking further clarification |

| 64 | We are getting different answers on what payroll is covered. One time, he said that it does not cover the hours before the PPP money was deposited in our accounts. Another time he said it was based on the date the check was written. Confused on which one it is? | Further clarification forthcoming. |

| 65 | We pay mid-year bonuses to employees. If these bonus payments fall within the 8-week period, is this included in forgiveness payroll calculations? | If these bonuses were included in the application then yes. If not in the application , then no. |

Here’s the recording of the webinar in it’s entirety.

Alex Kohls with SBA will be following up with the presentation and further clarification to several of the questions during the webinar. We will communicate any updates in this newsletter series. In the meantime, please do not hesitate to contact Horton Hobbs if you have any questions.

Horton H. Hobbs IV | vice president of economic development

937.521.1935 | hhobbs@greaterspringfield.com

greaterspringfield.com | expandgreaterspringfield.com