Creating a budget is a crucial step in managing your finances and ensuring that your money is working for you. Whether you start from scratch or use the auto-generate feature, this tool helps you set a realistic monthly budget by analyzing your income and expenses.

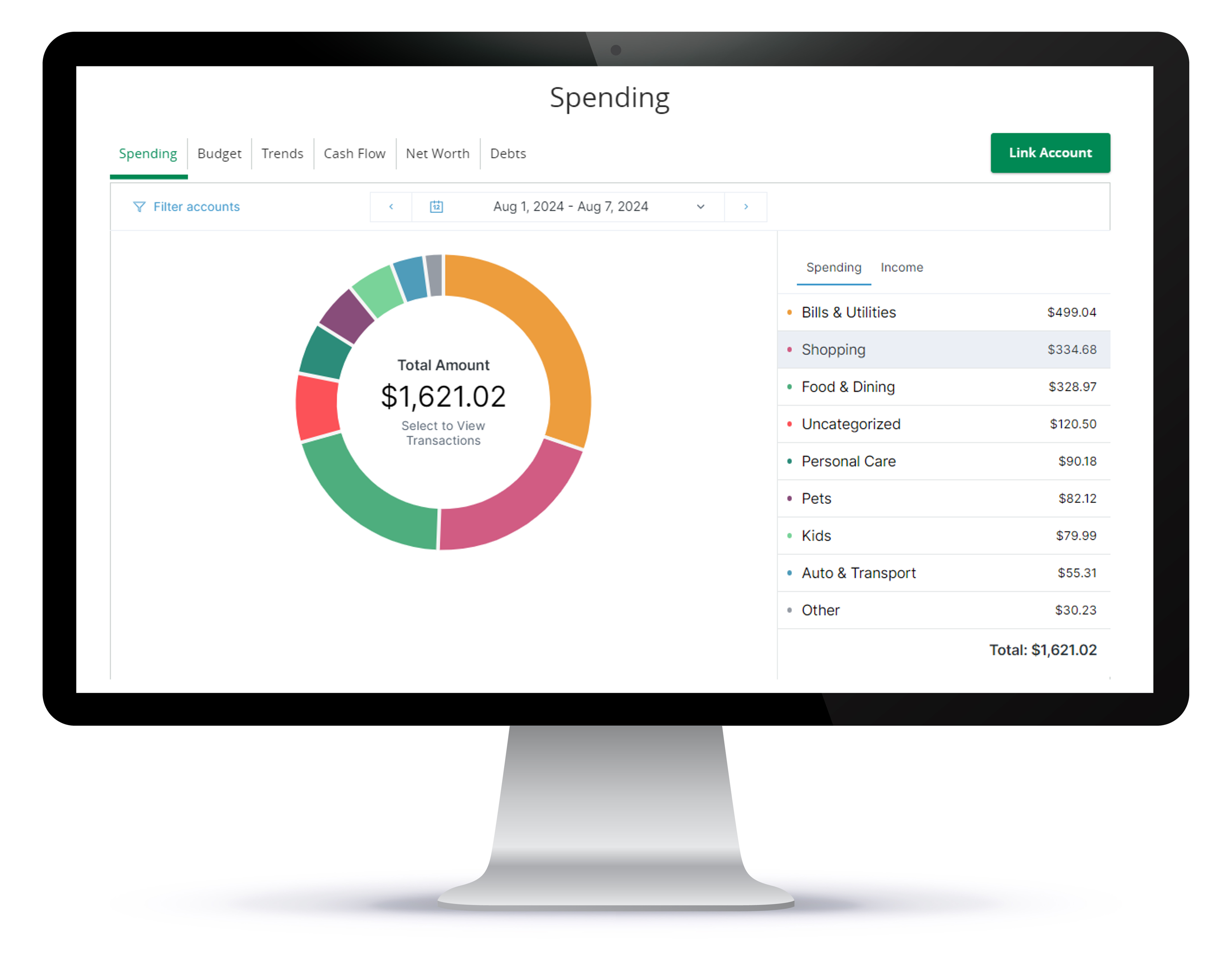

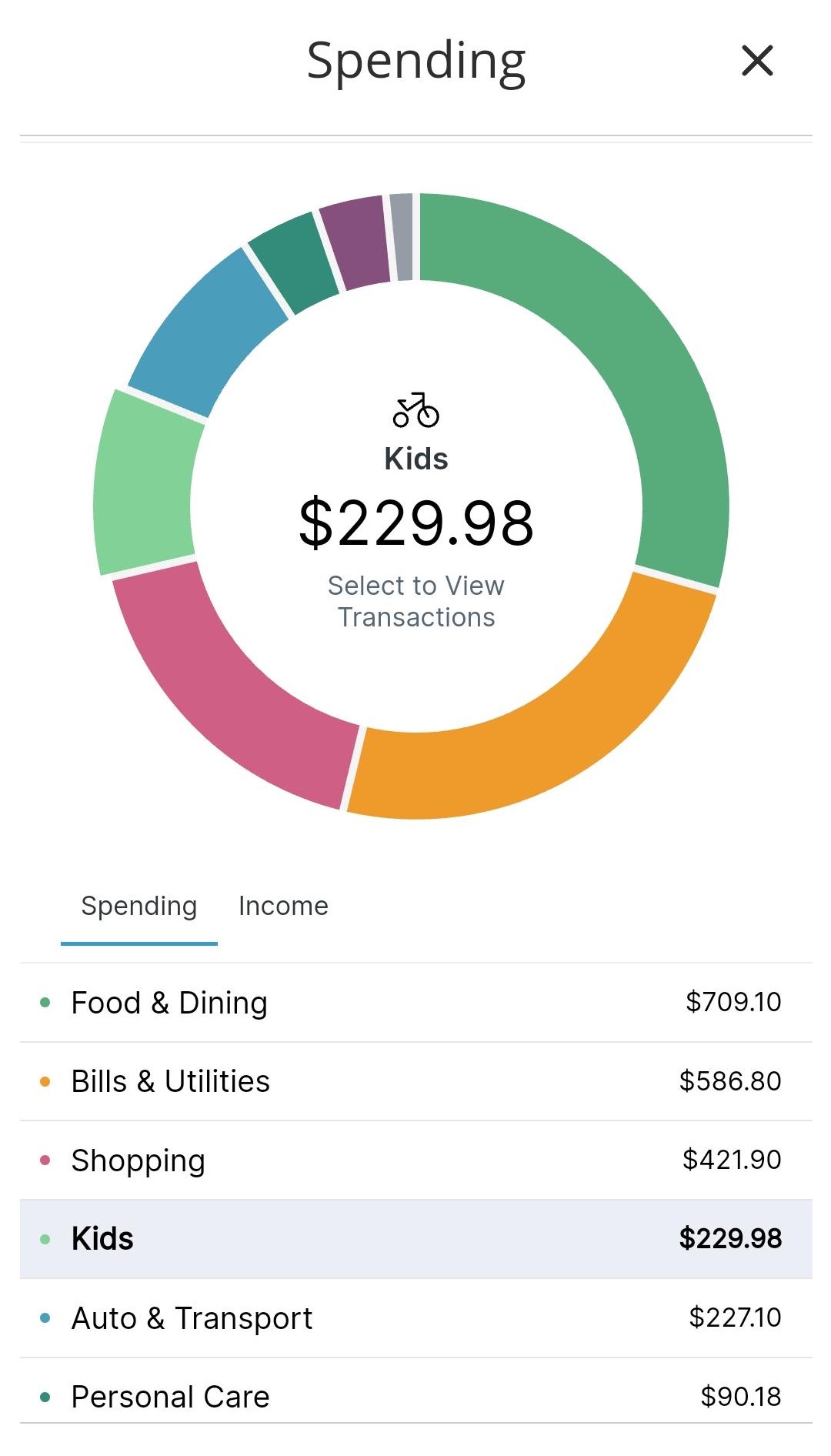

One of the key benefits of this tool is its ability to provide a clear, visual overview of your financial health. You can quickly see how your spending aligns with your budget, helping you stay on track and make informed decisions. Get a real-time understanding of where your money is going, empowering you to make adjustments as needed. This visual insight is essential for maintaining financial discipline and achieving your financial goals.